Although the compulsory superannuation guarantee has been in effect for more than 30 years, two out of three Australians fear they won’t have enough money in retirement. This lack of confidence increases as we get older, with 52% of baby boomers, 38% of Generation Xers and 31% of millennials not being confident about their retirement finances1.

But what does not having enough retirement savings look like? Here we take a closer look at the challenges faced by those who don’t have enough money in retirement.

How are living standards measured in retirement?

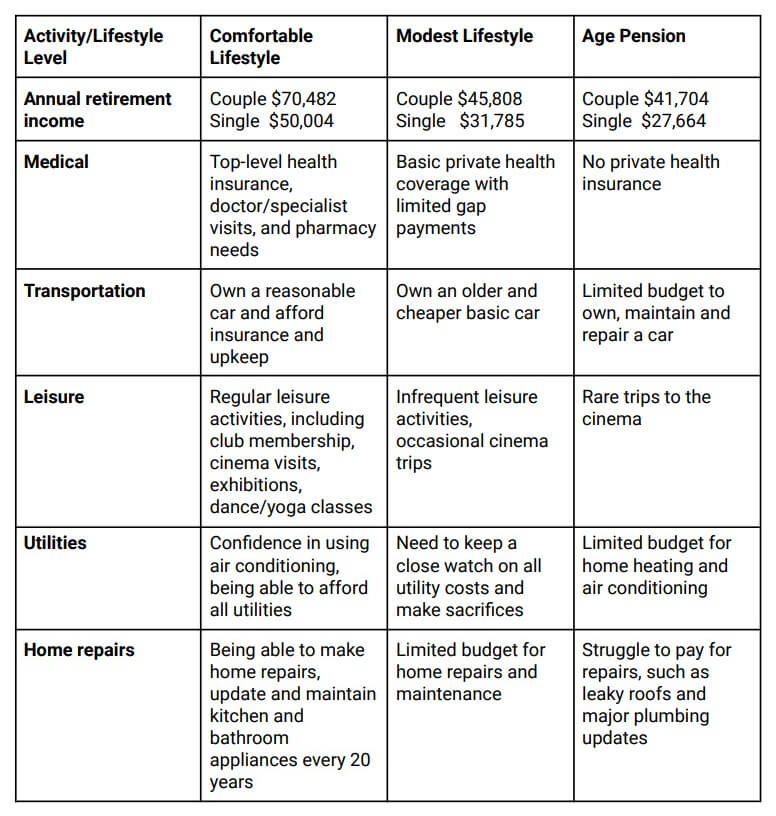

To compare lifestyles and income requirements in retirement, The Association of Superannuation Funds of Australia (ASFA) defines three levels of retirement living and shows what they look like. These levels are Comfortable Lifestyle, Modest Lifestyle and Age Pension. In all cases, the AFSA lifestyles assume that retirees own their own and are relatively healthy.

Here are a few examples of lifestyle differences between the three levels and the income ranges for each level.

While we all would like to be in the Comfortable Lifestyle column, many people won’t have enough saved up to live this way. According to ASFA’s latest figures, the savings needed at retirement for a comfortable lifestyle are $690,000 for couples and $595,000 for singles. Of course, this amount will increase each year due to inflation.

Too many people don’t think about retirement until it’s too late. Currently, around 1.5 million Australian retirees (out of 3.9 million) have to rely on the age pension as their primary source of income. As we see from the right-hand column, relying solely on the age pension in retirement means a bleak life, struggling to pay for basic needs and having a lower standard of living.

Adapting to life on the age pension

1. Continue to work past their desired retirement age

People who find themselves lacking in retirement savings and relying on the age pension can try to compensate by continuing to work. While some past retirement age might want to keep working, most people won’t. Even if you enjoy your work and have no firm time in mind about when you want to retire, it’s nice to have the flexibility to retire when you want to. Being forced to work means less time for leisure and time with family. Also, people experience health challenges later in life, making working difficult.

Another issue is working while receiving the age pension. Under current rules, a single pensioner can earn up to $180 per fortnight before having their pension reduced. Applying the Age Pension income test, if you earn over $180 per fortnight, your pension is reduced by 50 cents per dollar.

2. Reducing your income in retirement

You can reduce your income in retirement, but after working hard your entire life, wouldn’t you rather enjoy your retirement? As we have seen, there’s a big lifestyle difference between comfortable, modest and the age pension lifestyles.

3. Playing catch-up

You can invest more in the few years before retiring. While some people are in a position to do this, it’s often not possible as surplus funds are not available to do this. That’s why it’s important to start as soon as possible and not leave it until it’s too late.

4. Downsizing your home

Downsizing to a smaller home can be one way to boost retirement savings. But if you consider the scenario of downsizing from a $1 million home to a $700,000 home, the buying and selling costs – including marketing, legal, agent, moving fees and stamp duty – can range from $50,000 to $90,000. If you still have a mortgage on the home you plan to sell, your surplus will be even lower.

Realistically, with today’s property prices, you might not be able to find a suitable home in a location close to family and friends. While you can consider a regional area for lower housing prices, you could end up too far away from friends and loved ones and healthcare when you need it.

Why don’t people plan for retirement?

Given the big downsides to not planning, why aren’t more people prepared for retirement? Research conducted by YouGov2 revealed that:

- 34% of people think getting advice is too expensive

- 32% feel they don’t earn enough to make it worthwhile

- 19% simply procrastinate.

On the issue of cost, those who get advice can gain 8% to 29% in benefits, depending on when they start getting advice, regardless of their income. For example, a professional financial adviser can help you maximise your retirement savings by optimising your superannuation contributions.

Kicking the can down the road results in having less time to take steps that can help you achieve the retirement you want. After seeing the benefits of retirement planning, many of our new clients tell us, “I wish I had done this years ago.”

Get help to maximise your savings for a better retirement

There are many ways we can help you plan a better retirement. We can help you make this happen with strategies that include:

- Ensuring your investments are in line with your risk profile, including having adequate exposure to growth assets, which have higher returns over the long-term

- Advice to maximise your Centrelink Age Pension entitlement, which results in your own capital lasting longer

- Addressing ‘longevity risk’ – ensuring your money lasts a day longer than you do. Life expectancy is increasing, so many people will live in retirement for a considerable length of time and need to be able to fund it.

Creating a comfortable retirement requires dedicated planning and professional expertise. That’s where Finextra Wealth can help. We assist you with each stage of the process – from maximising your super while working (the accumulation phase) to managing your income during retirement (the drawdown phase), so you can live rich, not die rich.

Get in touch with a Finextra Wealth retirement specialist to discuss creating the retirement you want, not the one you have to settle for.

References:

1 https://www.findex.com.au/insights/article/preparing-for-retirement-two-in-three-australians-fear-they-dont-have-enough

2 https://www.findex.com.au/insights/article/preparing-for-retirement-two-in-three-australians-fear-they-dont-have-enough